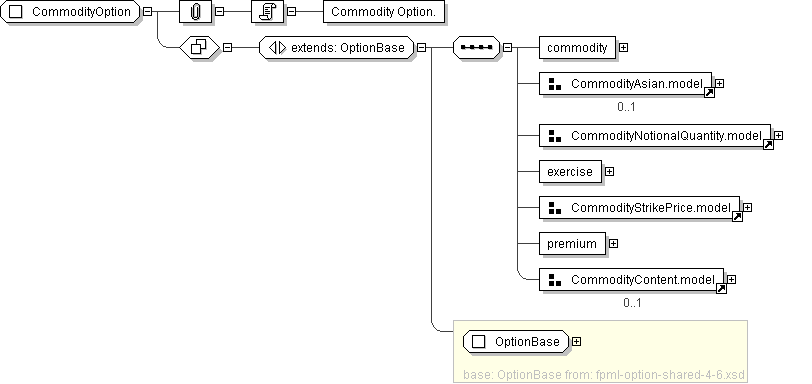

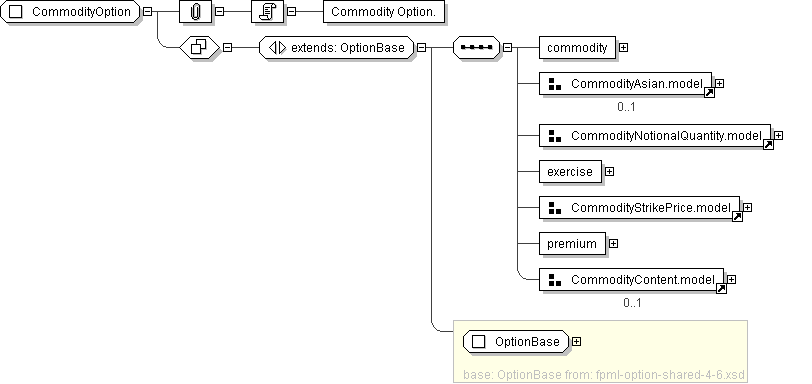

| Super-types: | OptionBase < CommodityOption (by extension) |

|---|---|

| Sub-types: | None |

| Name | CommodityOption |

|---|---|

| Used by (from the same schema document) | Element commodityOption |

| Abstract | no |

| Documentation | Commodity Option. |

'A classification of the type of product. FpML defines a simple product categorization using a coding scheme.'

'A product reference identifier allocated by a party. FpML does not define the domain values associated with this element. Note that the domain values for this element are not strictly an enumerated list.'

'A reference to the party that buys this instrument, ie. pays for this instrument and receives the rights defined by it. See 2000 ISDA definitions Article 11.1 (b). In the case of FRAs this the fixed rate payer.'

'A reference to the party that sells (\"writes\") this instrument, i.e. that grants the rights defined by this instrument and in return receives a payment for it. See 2000 ISDA definitions Article 11.1 (a). In the case of FRAs this is the floating rate payer.'

'The type of option transaction. From a usage standpoint, put/call is the default option type, while payer/receiver indicator is used for options index credit default swaps, consistently with the industry practice. Straddle is used for the case of straddle strategy, that combine a call and a put with the same strike.'

'Specifies the underlying component. At the time of the initial schema design, only underlyers of type Commodity are supported; the choice group in the future could offer the possibility of adding other types later.'

'A group containing properties specific to Asian options.'

'The effective date of the Commodity Option Transaction. Note that the Termination/Expiration Date should be specified in expirationDate within the CommodityAmericanExercise type or the CommodityEuropeanExercise type, as applicable.'

'A parametric representation of the Calculation Periods of the Commodity Option Transaction.'

'An absolute representation of the Calculation Periods of the Commodity Option Transaction.'

'The dates on which the option will price.'

'The Method of Averaging if there is more than one Pricing Date.'

'Allows the documentation of a shaped notional trade where the notional changes over the life of the transaction.'

'The parameters for defining how the commodity option can be exercised and how it is settled.'

'The currency amount of the strike price per unit.'

'Common pricing may be relevant for a Transaction that references more than one Commodity Reference Price. If Common Pricing is not specified as applicable, it will be deemed not to apply.'

'Market disruption events as defined in the ISDA 1993 Commodity Definitions or in ISDA 2005 Commodity Definitions, as applicable.'